On March 22, 2016, the Federal government announced the 2016-2017 budget. Certainly you have heard some of the highlights in the media.

As a valued client of the Wealth Stewards group, we wish to summarize the most important changes that may affect your family and your business.

The 2016-2017 budget proposed infrastructure spending of $120 billion over the next ten years, including investments in public transit, clean technology and First Nations. About $2 billion will be spent over 3 years on innovation, directed to post-secondary institutions and about $3 billion will be spent over a 5 year period The 2016-2017 budget deficit is estimated to be $29.4 billion, with debt-to-GDP to be approximately 32.5%.

The 2017-2018 is projected to be $29 billion, slowly reducing to $14.3 billion in 2020-2021. As a result, it can be prudent that we may expect further tax increases in the coming years.

Personal:

- OAS – The budget proposed to restore Old Age Security eligibility to 65 from 67.

- Family Tax Cut (income splitting) – proposed to be eliminated, re: the income splitting for couples with children under 18 years of age

- Children’s Fitness and Art Credits – will be phased out by 2017.

- Education and Textbook Tax Credits – will be eliminated as of January 1, 2017, however the more significant Tuition Credits remain

- Canada Child Benefit – will replace the Child Tax Benefit and the Universal Child Care Benefit (UCCB) as of July 2016. The maximum benefit is $6,400 based on family income.

- Flow-through shares – extends the 15% Mineral Exploration Tax Credit to March 31, 2017 as an incentive for investors in junior mineral exploration companies

- No changes made to the capital gains inclusion rate or stock options deduction

- Personal Service Businesses – increase in tax rates by 5%

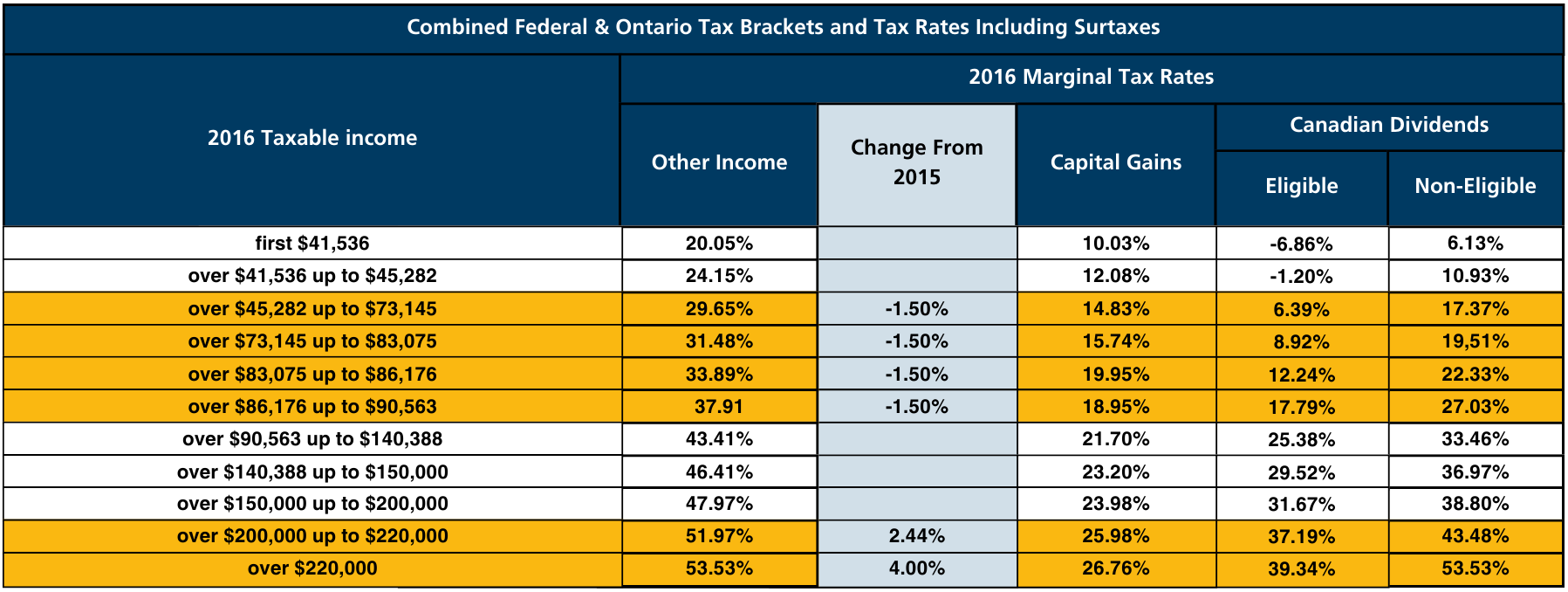

Here is a summary of the 2016 Combined Personal Tax Rates for Ontario residents, with changes from 2015 highlighted:

Business:

- Small Business Tax – the small business deduction will remain at 10.5% rather than reducing the rate to 9% by 2019 as previously planned. No direct changes were made to the treatment of non-eligible dividends paid from a small business.

- Professional corporations – no changes were made with respect to taxation.

Accelerated CCA for clean energy equipment – 30% or 50% for qualified energy generation and conservation equipment. - Other matters – related to cross border tax issues, transfer pricing and international tax treaties

- This is a high level summary of the budget announcements that may have an effect on your family. As always, if we can discuss any of the 2016 Federal Budget matters with you in more detail, please do not hesitate to call our consultants or email us at info@wealthstewards.ca.

All examples are for illustrative purposes only and are not intended to provide individual financial, investment, tax, legal or accounting advice. This material is for general information and is subject to change without notice. Every effort has been made to compile this material from a reliable source. However, we cannot guarantee that information will be accurate, complete and current at all times. Before acting on any of the above, please make sure to see a financial professional for advice based on your personal circumstances.